Withdrawal Options Overview

You can manage and control all the payouts for your vendor account from one dedicated area.

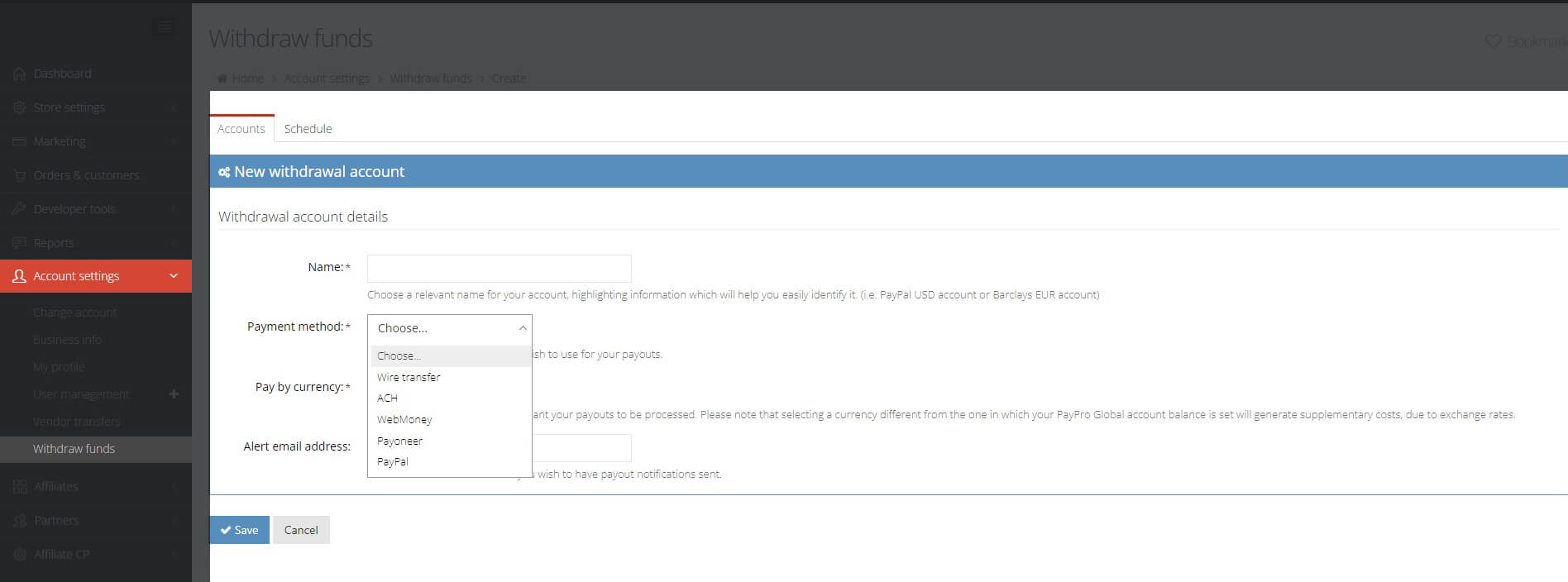

Add a New Account

To create a new account, go to Account settings -> Withdraw funds, click on the Add account button and you will be redirected to the New withdrawal account page. Here you may set the name for a withdrawal and choose the payment method and currency in which you want your payouts to be processed.

Screenshot

Having multiple currencies in your account balance will generate exchange rate costs.

Payment method options with the following fees per transaction include:

- Payoneer - $2 USD

- WebMoney - 3.5%+$5 USD

- Wire Transfer - $21 USD

- ACH (North America) - $3 USD

PayPal:

- For US & Canada - Free

- Internationally - 2% (max $20 USD fee)

Schedule Withdrawals

Once you have set up your withdrawal account you can define the dates and frequency with which you wish to transfer funds from your PayPro Global account to your defined external account.

-

Payouts are processed usually on the 15th of every month. The amount of the payout matches the previous month's closing balance, minus the payout fees and other adjustments if any.

-

The withdrawals need to be set up as scheduled operations, so you need to go to Schedule and perform the setup there.

If you decide to create multiple withdrawal accounts (for different banks, currencies, etc) keep in mind that payouts will be processed based on the order of your schedule. For example, the first scheduled account will receive a payout calculated based on the full payout value available, the second scheduled account will receive a payout calculated based on the payout value remaining after the first payment, etc.

In addition, PayPro Global's system will automatically generate Acceptance Letters for each payout recorded in your account. These documents can be found in the Acceptance letters tab of the Withdraw funds section.